Introduction

Tax season can be a stressful time, and waiting for a refund can feel like an eternity. If you’ve filed your taxes using FreeTaxUSA, you may be wondering, “How long does FreeTaxUSA take to refund?” This article will delve into the intricacies of FreeTaxUSA’s refund process, providing you with a comprehensive understanding of the timelines involved. We’ll also explore factors that can impact the speed of your refund and offer practical tips to maximize your chances of a swift resolution.

Image: www.msn.com

Understanding FreeTaxUSA’s Refund Process

When you file your taxes using FreeTaxUSA, the process typically unfolds as follows:

- e-Filing: If you choose to e-file, your return is electronically transmitted to the Internal Revenue Service (IRS) or your respective state tax agency.

- Processing: The IRS and state agencies review your return and verify the accuracy of your information. This process typically takes a few weeks.

- Approval: Once your return is approved, the IRS or state agency begins the process of calculating your refund.

- Refund Issuance: Once your refund amount is finalized, the IRS or state agency will issue your refund via direct deposit or mail.

Estimated Refund Timeline

The IRS typically states that most e-filed returns are processed within 21 days of filing. However, there are several factors that can impact the speed of your refund, including:

- Complexity of Your Return: Returns with complex schedules or additional forms may require additional processing time.

- Method of Filing: E-filed returns are generally processed faster than paper-filed returns.

- Tax Year: The IRS and state agencies may experience higher processing volumes during peak tax seasons.

- IRS Backlog: The IRS may be experiencing a backlog of returns, which can delay processing times.

Based on these factors, FreeTaxUSA estimates that most e-filed returns are funded within 10-14 days after the IRS or state agency accepts your return. However, it’s important to note that these are just estimates, and your refund may take longer depending on the circumstances.

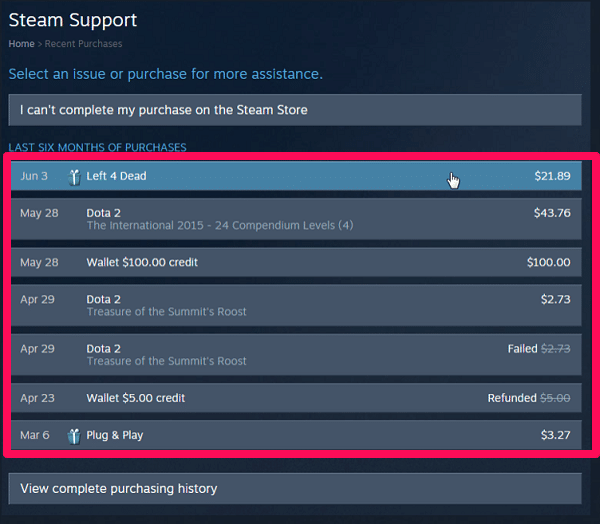

How to Track Your Refund

Once you’ve filed your taxes, you can track your refund status using the following methods:

- IRS Website: Visit the IRS’s Where’s My Refund? page at https://www.irs.gov/refunds to check the status of your federal refund.

- FreeTaxUSA Website: If you filed your taxes using FreeTaxUSA, you can sign in to your account to track the status of your state and federal refunds.

- IRS Phone Line: You can call the IRS at 1-800-829-1954 to speak with a representative about your refund status.

Tips for a Speedy Refund

To maximize your chances of receiving your refund as quickly as possible, consider the following tips:

- File Electronically: E-filing is the fastest way to file your taxes and receive your refund.

- File Early: Filing your taxes early helps avoid potential backlogs and delays.

- Choose Direct Deposit: Direct deposit is the most efficient way to receive your refund.

- Review Your Return Carefully: Thoroughly reviewing your return before filing can help prevent delays caused by errors or omissions.

- Consider Using FreeTaxUSA’s Paid Filing Options: While FreeTaxUSA offers a free filing option, upgrading to a paid version can provide additional support and features that may streamline the refund process.

Conclusion

While the exact timeline for receiving your FreeTaxUSA refund can vary, understanding the process involved and employing effective strategies can help you maximize your chances of a speedy resolution. By choosing to e-file, filing early, opting for direct deposit, reviewing your return carefully, and considering paid filing options, you can minimize delays and receive your refund as efficiently as possible. Remember, the IRS and state agencies strive to process refunds promptly, but potential factors and backlogs can impact the timeframe. If you have any concerns or questions about your refund status, don’t hesitate to contact the IRS or FreeTaxUSA for assistance.

Image: www.damonx.com

How Long Does Freetaxusa Take To Refund